Top 5 Medicare Mistakes Fort Myers Residents Make (And How to Avoid Them)

Medicare enrollment can feel overwhelming, especially for Fort Myers residents who want to ensure they’re covered as they transition into retirement. With enrollment deadlines, plan choices, and potential penalties, a simple oversight can cost you thousands of dollars or leave you without essential healthcare coverage. Understanding the top mistakes people make can help you avoid them, protect your health, and save money.

Below are the five most common Medicare mistakes in Fort Myers, along with practical ways to steer clear of them.

1. Missing the Initial Enrollment Period

Why This Mistake Happens

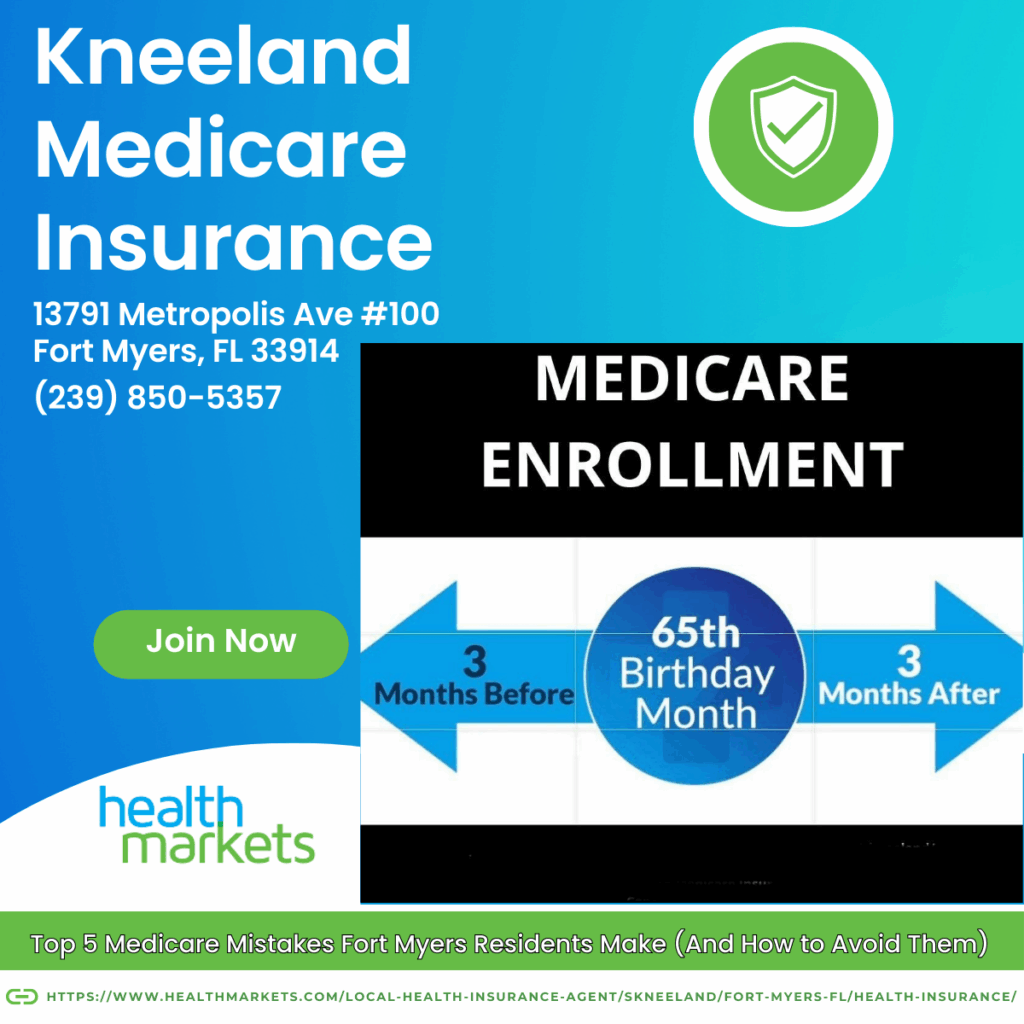

Many assume Medicare enrollment is automatic at age 65. However, it only happens automatically if you are already receiving Social Security benefits. Anyone else must actively enroll during their Initial Enrollment Period (IEP), which starts three months before your 65th birthday and ends three months after.

The Consequences

Late enrollment penalties for Part B and Part D that last a lifetime

Gaps in healthcare coverage while waiting for the next enrollment window

Higher out-of-pocket costs for services or prescriptions

How to Avoid It

Mark your calendar well before turning 65 and seek guidance from a licensed Medicare advisor in Fort Myers. Even if you’re still working, make sure you understand whether your employer coverage qualifies you for a delay without penalties.

2. Choosing the Wrong Plan for Your Needs

Why This Mistake Happens

Plan comparison can be confusing with so many choices between Original Medicare, Medicare Advantage (Part C), and various Medigap (Supplement) plans. Some choose based on premium alone without considering copays, networks, or prescription coverage.

The Consequences

Paying too much for unnecessary coverage

Finding your preferred Fort Myers doctors are out of network

Struggling with high prescription costs due to a poorly matched Part D plan

How to Avoid It

Review your healthcare needs such as prescriptions, doctor preferences, and budget. Work with a local Fort Myers Medicare advisor who can compare plans side by side. Remember: the lowest premium isn’t always the best value.

3. Ignoring Prescription Drug Coverage (Part D)

Why This Mistake Happens

Healthy individuals may believe they are saving money by going without drug coverage until they need it.

The Consequences

Medicare imposes a permanent late enrollment penalty if you delay Part D without other credible drug coverage

You could face extremely high out-of-pocket costs down the road if you unexpectedly need prescriptions

Your access to certain affordable medications may be limited

How to Avoid It

Enroll in at least a basic Part D plan when you’re eligible. Even if you only take a few medications, coverage will protect you from future penalties and sudden medical expenses. Compare plans each year since formularies often change.

4. Not Reviewing Coverage During Annual Enrollment

Why This Mistake Happens

Life gets busy, and many don’t realize that Medicare plans can change benefits, networks, and premiums annually. Some residents also assume what worked last year will automatically remain the best choice next year.

The Consequences

Your doctors or specialists may no longer be in-network

Premiums and copays may increase without you realizing

Prescription coverage may no longer align with your medications, costing you more

How to Avoid It

Take advantage of the Annual Enrollment Period (AEP) every fall, from October 15 to December 7. Compare your current plan with new options available in Fort Myers. Even if you stay with the same company, reviewing ensures you aren’t surprised by changes come January.

5. Overlooking Out-of-Pocket Costs

Why This Mistake Happens

It’s easy to be drawn to low premiums or “zero-dollar Medicare Advantage plans” marketed in Fort Myers. However, premiums are only part of the total cost of care.

The Consequences

Higher-than-expected hospital or specialist copays

Surprise bills for services not covered

Difficulty budgeting for healthcare in retirement

How to Avoid It

Look closely at the maximum out-of-pocket limits and copay structures—not just the premium. If you have ongoing health conditions, consider whether a Medicare Supplement plan could be more predictable and cost-effective.

The Importance of Local Guidance

Why Local Support Matters

Medicare rules are federal, but your options and provider networks are highly local. Fort Myers residents benefit from working with advisors who understand local hospitals such as Lee Health and know which Advantage plans have the strongest networks in the region.

Medicare Tips for Fort Myers Residents

Actionable Strategies

Review your plan every year during AEP

Confirm your preferred doctors and specialists are covered before committing to a plan

Keep a current list of medications and check if formularies still cover them each year

Don’t ignore preventive services—many are included at no cost and help you avoid larger expenses later

Consider working with a trusted local Medicare agent to ensure personalized support

Final Thoughts

Key Takeaways

Medicare enrollment is one of the most important decisions you’ll make as you approach retirement in Fort Myers. By avoiding these five common mistakes—missing enrollment deadlines, choosing the wrong plan, skipping Part D, failing to review coverage, and overlooking out-of-pocket costs—you’ll protect both your health and your budget.

If you feel overwhelmed, don’t go it alone. Speaking with a knowledgeable Medicare advisor in Fort Myers can give you confidence, clarity, and peace of mind as you navigate this important stage of life.