Medicare Open Enrollment Cape Coral - LP Insurance Solutions

Understanding Medicare Open Enrollment 2025

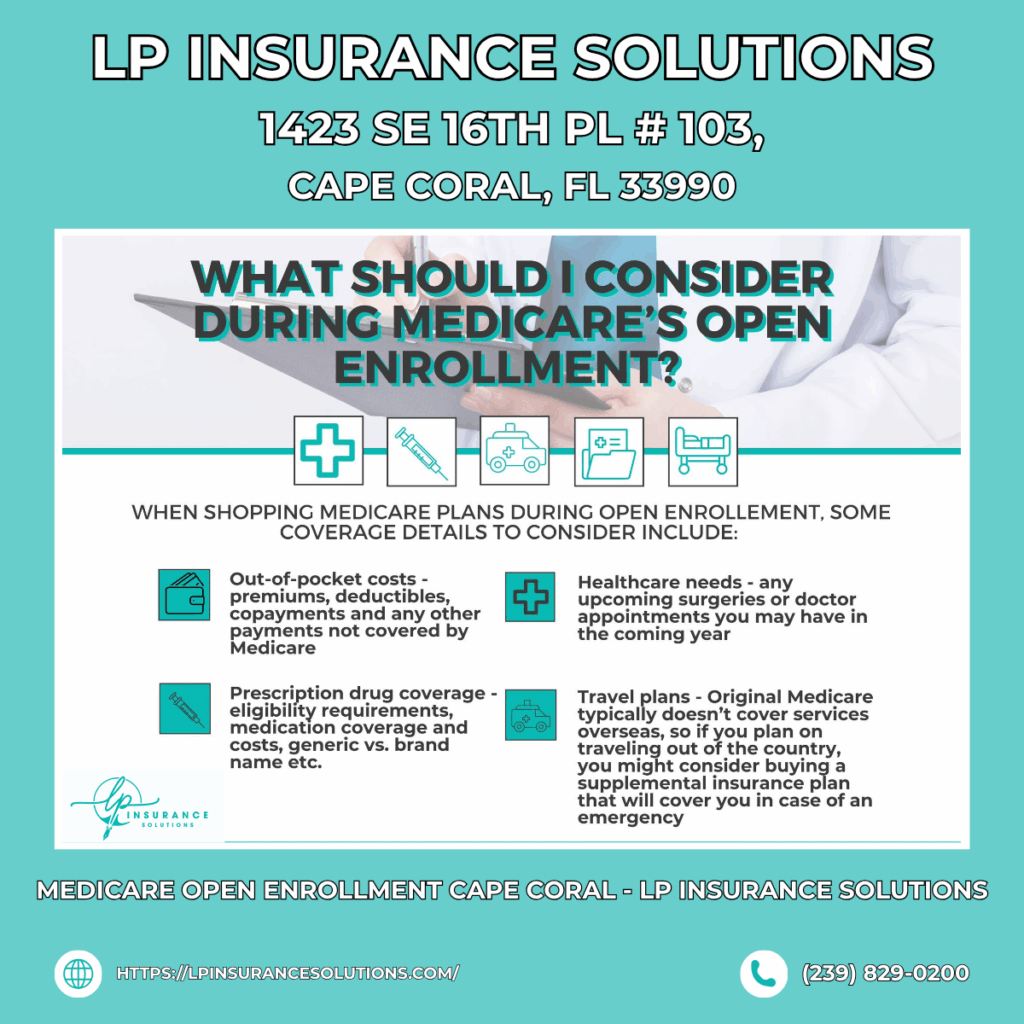

Another enrollment season brings crucial decisions for Cape Coral’s Medicare beneficiaries. The annual enrollment period creates opportunities to optimize healthcare coverage, reduce costs, and ensure your plan aligns with current health needs. Running from mid-October through early December, this window demands attention from anyone currently enrolled in Medicare.

Many beneficiaries mistakenly believe their current plan automatically remains the best option. However, insurance carriers frequently modify plan structures, adjust provider networks, change prescription formularies, and alter cost-sharing arrangements. What served you well previously might now contain gaps or unnecessary expenses.

Cape Coral’s growing senior population faces unique considerations when selecting Medicare coverage. Access to quality healthcare facilities, proximity to specialists, and coverage for preferred physicians all influence plan selection. Additionally, Florida’s specific healthcare landscape requires understanding how national Medicare plans adapt to local market conditions.

What Changes Can You Make This Year?

Open enrollment provides remarkable flexibility to reshape your healthcare coverage. Perhaps the most significant change available involves switching between Original Medicare and Medicare Advantage plans. This decision fundamentally alters how you receive Medicare benefits and which providers you can access.

Beneficiaries enrolled in Medicare Advantage can switch to any other Advantage plan available in their area. This flexibility allows you to pursue better benefits, lower costs, or improved provider networks. Given that Cape Coral offers multiple Medicare Advantage options, comparison shopping can yield substantial improvements.

Prescription drug coverage modifications represent another vital change opportunity. You can enroll in, switch, or drop Part D plans during this period. Given medication cost volatility and frequent formulary changes, reviewing drug coverage annually protects against unexpected expenses.

For those considering supplemental coverage, open enrollment provides an ideal time to evaluate Medigap options. While changing Medigap plans typically requires medical underwriting, assessing whether your current supplemental insurance meets your needs helps you plan for future coverage decisions.

Who Is Eligible for Medicare Open Enrollment?

Anyone currently enrolled in Medicare Parts A and B qualifies for the Annual Open Enrollment Period. This includes the vast majority of beneficiaries aged 65 and older, along with younger individuals who qualify through disability status or specific medical conditions.

Individuals receiving Social Security Disability Insurance for 24 months automatically qualify for Medicare regardless of age. Those diagnosed with End-Stage Renal Disease or Amyotrophic Lateral Sclerosis (ALS) also qualify without waiting periods, entering Medicare immediately upon diagnosis.

Recent retirees transitioning from employer-sponsored coverage should understand their enrollment rights and obligations. If you’ve maintained creditable coverage through an employer, you typically receive a Special Enrollment Period when that coverage ends. However, participating in the Annual Open Enrollment provides an opportunity to explore all available options simultaneously.

Cape Coral residents who’ve recently moved to the area need to verify their Medicare plan coverage extends to their new location. Many Medicare Advantage plans have specific service areas, and relocating might necessitate plan changes even outside typical enrollment periods.

How to Compare Cape Coral Medicare Plans

Effective plan comparison requires systematic evaluation of multiple coverage components. Begin by documenting your current healthcare utilization, including regular medications, specialist appointments, planned procedures, and preferred providers. This baseline helps you assess how different plans would accommodate your actual needs.

Network adequacy represents a critical comparison factor. Medicare Open Enrollment Cape Coral specialists emphasize verifying that your preferred doctors, hospitals, and healthcare facilities participate in any plan you’re considering. Switching plans only to discover your longtime physician isn’t covered creates frustrating complications.

Prescription drug coverage demands detailed analysis. Medications fall into different tiers with varying cost-sharing requirements. A plan with a lower premium might place your medications in higher cost tiers, ultimately costing more despite the attractive base price. Additionally, some plans require prior authorization or step therapy for certain medications, potentially delaying access to needed prescriptions.

Maximum out-of-pocket limits provide crucial financial protection. These caps limit your annual cost exposure for covered services. Plans with lower out-of-pocket maximums offer better catastrophic protection, though they might carry higher monthly premiums. Consider your risk tolerance and financial situation when weighing these trade-offs.

Extra benefits increasingly differentiate Medicare Advantage plans. Many plans now include dental, vision, hearing, fitness memberships, or over-the-counter allowances. While these perks shouldn’t drive your decision alone, they add meaningful value if you’ll actually use them.

Initial vs. Open vs. Special Enrollment: Explained

Medicare offers several enrollment periods designed to accommodate different circumstances. Your Initial Enrollment Period represents your first opportunity to join Medicare, typically surrounding your 65th birthday. This seven-month window begins three months before your birthday month and extends three months afterward.

Missing your Initial Enrollment Period can trigger permanent premium penalties unless you maintain creditable coverage through employment or another qualifying source. These penalties accumulate based on delay length and continue throughout your Medicare enrollment, making timely action financially important.

The Annual Open Enrollment Period runs October 15 through December 7 yearly. During this window, any current Medicare beneficiary can modify their coverage. Changes take effect January 1, providing several weeks for insurance carriers to process enrollments and send plan materials.

Special Enrollment Periods address qualifying life events warranting immediate coverage changes. Moving outside your plan’s service area, losing employer coverage, entering or leaving institutional care, or gaining eligibility for financial assistance programs can trigger Special Enrollment Periods with specific timeframes.

The Medicare Advantage Open Enrollment Period, running January 1 through March 31, provides an additional change opportunity specifically for Advantage plan enrollees. During this period, you can switch Advantage plans once or return to Original Medicare with Part D coverage, though options are more constrained than during the fall enrollment window.

Tips to Avoid Penalties and Maximize Savings

Penalty avoidance begins with understanding enrollment deadlines and maintaining continuous coverage. The Part B late enrollment penalty equals 10% of the standard premium for each full 12-month period without coverage. This surcharge doesn’t expire, making it a permanent cost increase.

Part D prescription coverage penalties accumulate at 1% of the national base beneficiary premium multiplied by uncovered months. Like Part B penalties, this charge persists indefinitely. Even if you don’t currently take medications, enrolling in Part D prevents future penalties when prescriptions become necessary.

When residents compare Medicare plans Cape Coral providers offer, they should review plan Star Ratings. These quality measures, ranging from one to five stars, reflect plan performance across multiple dimensions including customer service, member complaints, and health outcomes. Higher-rated plans often provide better overall experiences.

Consider Total Cost of Care rather than focusing exclusively on monthly premiums. Add your annual premiums, expected copays, coinsurance, prescription costs, and potential out-of-pocket maximums to understand true cost exposure. A plan with higher premiums but lower cost-sharing might ultimately cost less if you have significant healthcare needs.

Leverage local resources to inform your decision. Cape Coral offers various Medicare counseling services, including SHINE (Serving Health Insurance Needs of Elders) counselors who provide free, objective guidance. These trained volunteers help you navigate plan options without sales pressure or conflicts of interest.

Time your enrollment strategically within the open enrollment window. While acting early ensures ample processing time, waiting until after insurance carriers release final plan details for the upcoming year guarantees you’re comparing accurate information. Most carriers finalize details by early October, making mid-to-late October ideal for serious comparison.

Document everything related to your Medicare enrollment. Maintain records of plan selections, confirmation numbers, application dates, and all correspondence. This documentation proves invaluable if disputes arise regarding enrollment timing, plan selection, or coverage details.

Review your coverage annually without exception. Even if you’re satisfied with your current plan, carriers modify plans yearly. Your insurer might reduce benefits, increase cost-sharing, narrow provider networks, or change prescription formularies. Annual reviews ensure you’re not unknowingly accepting diminished value.