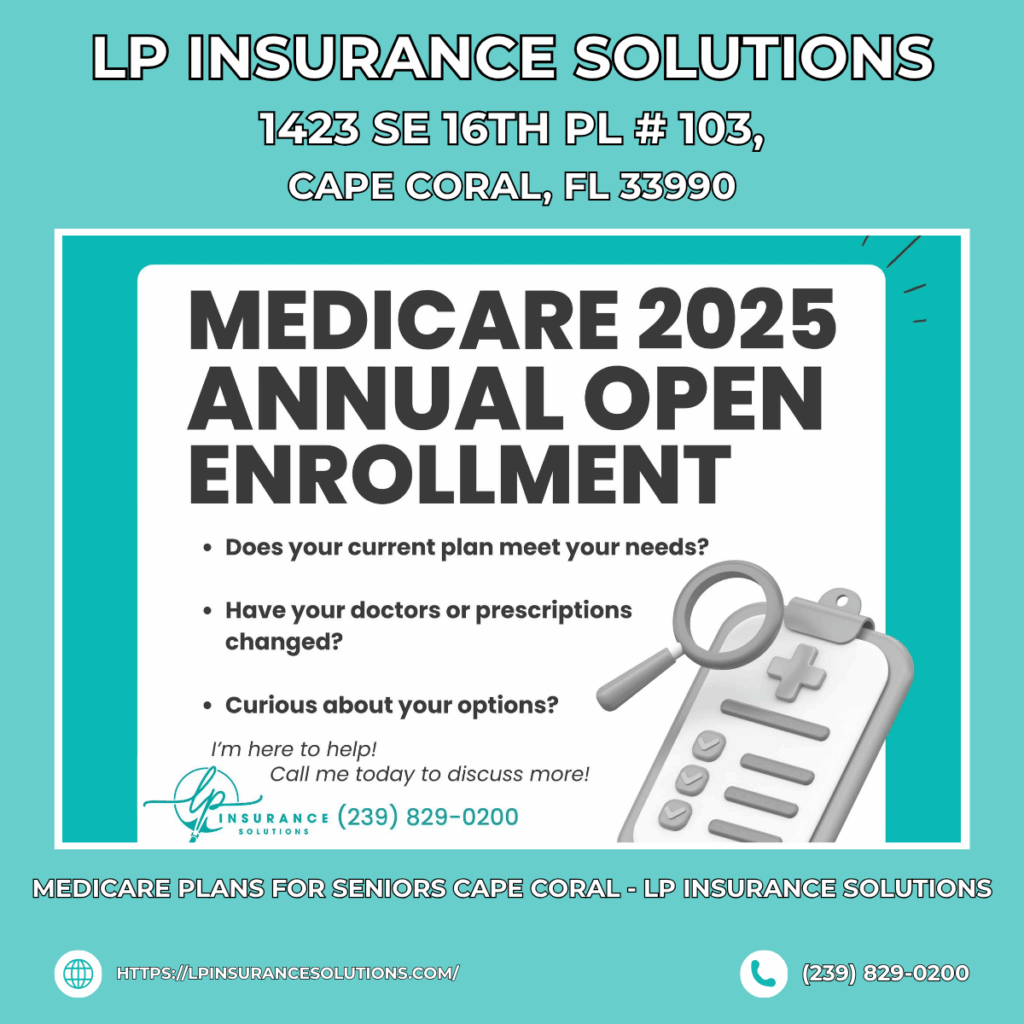

Medicare Plans for Seniors Cape Coral - LP Insurance Solutions

Introduction – Overview of Medicare Plans for Seniors

For seniors in Cape Coral, Florida, understanding Medicare coverage options represents a critical step toward maintaining health and financial security during retirement years. Medicare provides foundational health insurance for individuals 65 and older, but the variety of available plans can create confusion for those new to the program or seeking better coverage.

Cape Coral’s growing senior population has access to numerous Medicare options, each with distinct features, costs, and benefits. From traditional government-administered plans to private insurance alternatives, the choices require careful consideration. Making an informed decision means evaluating your health needs, budget, preferred healthcare providers, and lifestyle factors.

This comprehensive guide illuminates the Medicare landscape specific to Cape Coral residents. Whether you’re approaching your 65th birthday, recently relocated to Southwest Florida, or simply want to optimize your existing coverage, understanding your options empowers you to secure the healthcare protection you deserve. Local resources and expert advisors stand ready to assist Cape Coral seniors through every step of the Medicare journey.

Types of Medicare Plans Available

Medicare’s structure includes several distinct plan categories, each designed to address different coverage priorities and healthcare philosophies. Recognizing these categories and their characteristics forms the foundation for smart plan selection.

The Medicare ecosystem consists of Original Medicare (Parts A and B), Medicare Advantage Plans (Part C), Medicare Supplement Insurance (Medigap), and Prescription Drug Plans (Part D). Some plans combine multiple coverage types, while others require separate policies for comprehensive protection.

Timing matters significantly in Medicare enrollment. Missing your Initial Enrollment Period can result in coverage gaps and permanent premium penalties. Understanding enrollment windows helps Cape Coral seniors avoid these pitfalls and maintain continuous healthcare coverage.

Original Medicare vs Medicare Advantage

Original Medicare, administered directly by the federal government, provides Part A hospital insurance and Part B medical insurance. This traditional option offers nationwide provider flexibility, allowing beneficiaries to visit any doctor or hospital accepting Medicare patients. For Cape Coral residents who travel frequently or have established relationships with medical providers outside the area, this flexibility proves invaluable.

Medicare Advantage Plans represent an alternative approach where private insurance companies deliver Medicare benefits. These plans must cover everything Original Medicare does but frequently enhance the package with prescription drug coverage, dental services, vision care, hearing benefits, and wellness programs. Many Medicare Plans for Seniors Cape Coral beneficiaries appreciate these all-in-one solutions.

The primary consideration with Medicare Advantage involves network limitations. Most plans operate as HMOs or PPOs, restricting coverage to specific provider networks primarily within Lee County and surrounding areas. For seniors comfortable receiving care locally and attracted to lower out-of-pocket costs with added benefits, Medicare Advantage often presents excellent value.

Medicare Supplement Insurance (Medigap)

Medigap policies exist to address the gaps in Original Medicare coverage, specifically the out-of-pocket expenses like deductibles, copayments, and coinsurance that beneficiaries would otherwise pay themselves. Ten standardized Medigap plans exist, each identified by a letter and offering identical benefits nationwide, regardless of which insurance company sells the policy.

The standardization simplifies comparison shopping for Cape Coral seniors. Plan G, for instance, covers the same benefits whether purchased from Company A or Company B, though premiums may differ. This transparency helps beneficiaries focus on price and company reputation rather than benefit confusion.

Medigap shines for those valuing provider freedom and travel flexibility. With Medigap coverage, you can visit any doctor accepting Medicare nationwide without network restrictions or referral requirements. This proves particularly beneficial for snowbirds, frequent travelers, or those seeking specialized care from experts anywhere in the country.

How Seniors Benefit from Local Plan Experts

Cape Coral’s Medicare advisors bring localized expertise that generic national resources cannot match. These professionals maintain current knowledge about which plans offer the best provider networks for Lee Memorial Hospital, Cape Coral Hospital, and local medical practices throughout the area.

Local experts conduct personalized needs assessments, reviewing your health conditions, prescription medications, preferred doctors, and financial situation. This comprehensive approach identifies plans optimally suited to your specific circumstances rather than generic recommendations that may not fit your needs.

Medicare Plans for Seniors Cape Coral specialists also provide crucial support during enrollment processes, helping complete applications accurately and ensuring timely submission. They explain complex policy language in plain English, empowering you to make confident decisions.

Beyond initial enrollment, these advisors offer ongoing relationships. They conduct annual plan reviews, alert you to better options as they emerge, assist with claims issues, and answer coverage questions year-round. This continuity of support creates peace of mind that you’re always optimally covered.

Common Coverage Questions Answered

Understanding exactly what Medicare covers under different plan configurations prevents unwelcome surprises and helps seniors budget accurately for healthcare expenses.

Original Medicare Part A primarily covers inpatient hospital care, including semi-private rooms, meals, nursing care, and necessary services during hospital stays. It also covers skilled nursing facility care following hospital stays, hospice care for terminal illnesses, and limited home healthcare services. Part B covers physician services, outpatient care, preventive services like screenings and vaccines, durable medical equipment, and mental health services.

Medicare Advantage Plans encompass all Part A and Part B services but often add valuable supplemental benefits. Many include prescription drug coverage integrated into the plan, eliminating the need for separate Part D enrollment. Additional benefits frequently cover dental cleanings and fillings, annual eye exams with eyewear allowances, hearing exams and hearing aids, and fitness memberships.

Medigap policies specifically address cost-sharing requirements in Original Medicare. Depending on the plan letter chosen, Medigap can cover Part A hospital deductibles and coinsurance, Part B annual deductibles and coinsurance, excess charges from doctors who don’t accept Medicare assignment, and emergency healthcare during foreign travel.

Tips for Choosing the Right Medicare Plan in Cape Coral

Selecting your Medicare plan demands systematic evaluation of multiple factors to ensure optimal coverage and value.

Begin with a provider assessment. List all current doctors, specialists, and preferred hospitals, then verify their participation in plans you’re considering. Changing beloved, trusted physicians should be a deliberate choice, not an unwelcome surprise after enrollment.

Prescription drug analysis deserves careful attention. Compile all current medications with dosages, then use Medicare’s Plan Finder tool to calculate annual drug costs under different plans. Some Medicare Plans for Seniors Cape Coral residents choose may feature attractive premiums but significantly higher prescription costs, negating apparent savings.

Assess your healthcare utilization realistically. Track how often you visit doctors, specialists, and urgent care facilities. Review past years’ medical expenses to identify patterns. High utilizers typically benefit from plans with higher premiums but lower per-visit costs, while healthy seniors with minimal care needs might prefer lower premiums with higher cost-sharing.

Evaluate total annual costs comprehensively. Add monthly premiums to expected deductibles, copayments, coinsurance, and potential maximum out-of-pocket expenses. The plan with the lowest premium may not deliver the lowest total cost once all factors are considered.

Consider future health needs, not just current status. If you’re managing chronic conditions likely to require increasing care, prioritize plans offering robust coverage and reasonable out-of-pocket maximums. Conversely, if you’re exceptionally healthy, you might accept higher deductibles to secure lower premiums.

FAQs about Medicare Plans for Seniors

What’s covered under different plans?

Original Medicare provides comprehensive hospital and medical coverage but excludes prescriptions, routine dental, routine vision, and hearing aids. Medicare Advantage Plans include all Original Medicare benefits plus frequently add prescription drugs, dental, vision, hearing, and wellness perks like gym memberships. Medigap supplements Original Medicare by covering out-of-pocket costs but doesn’t include prescriptions or supplemental benefits, requiring separate Part D enrollment.

How much do plans cost?

Medicare costs vary considerably by plan type and selection. Original Medicare requires a Part B premium ($174.70 standard monthly amount in 2024 for most beneficiaries), potential Part A premium if you haven’t paid sufficient Medicare taxes, and separate Part D drug plan costs. Medicare Advantage premiums range from $0 to $200+ monthly beyond Part B. Medigap premiums in Cape Coral typically range $100-$350 monthly depending on age, plan letter, and insurance carrier.

Can I change plans during the year?

Plan changes typically occur during designated enrollment periods. The Annual Enrollment Period spans October 15 through December 7 annually, allowing switches between Original Medicare and Medicare Advantage or changes to Part D coverage. Medicare Advantage enrollees have an additional opportunity during the Medicare Advantage Open Enrollment Period (January 1 – March 31) to switch plans once. Certain qualifying life events trigger Special Enrollment Periods permitting mid-year changes..